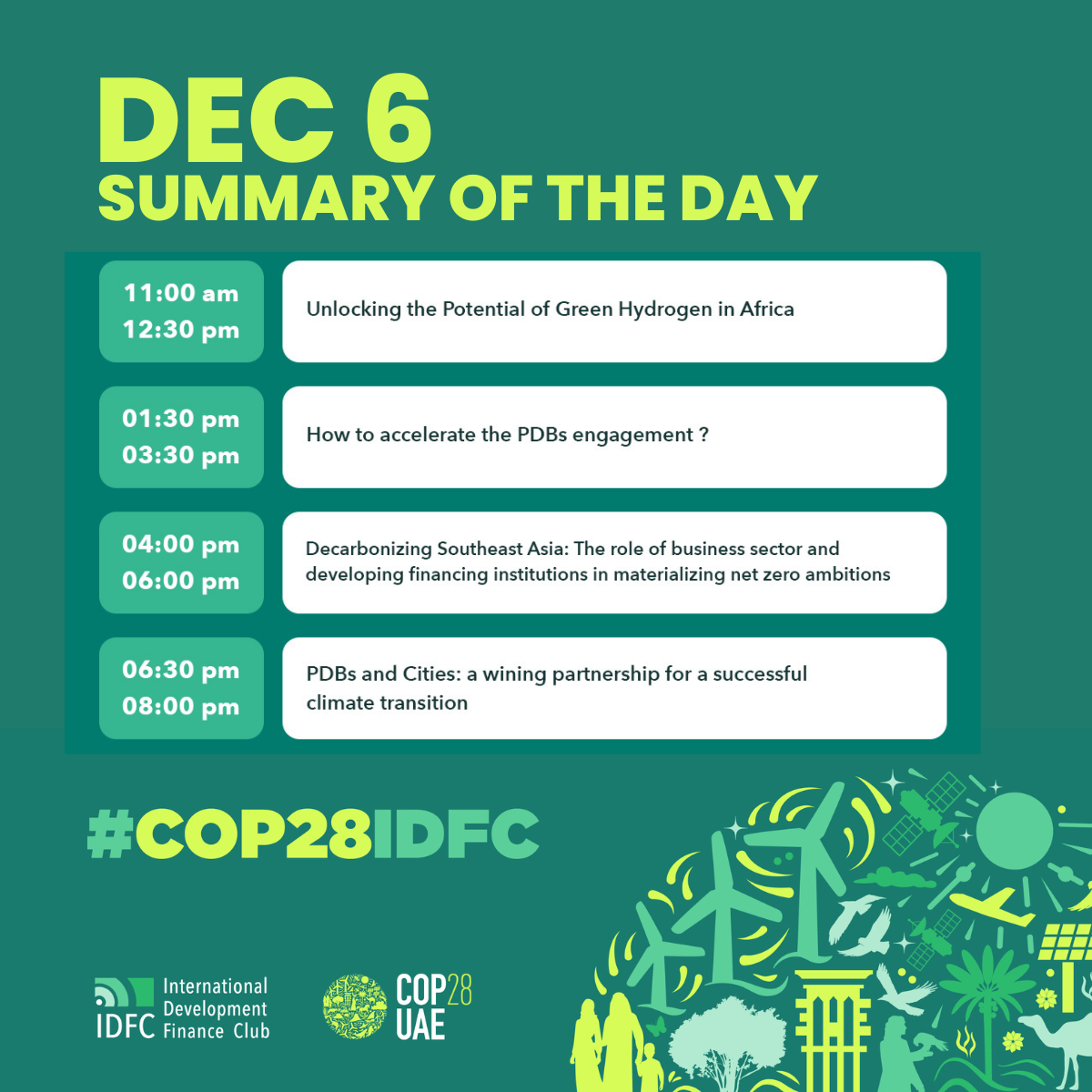

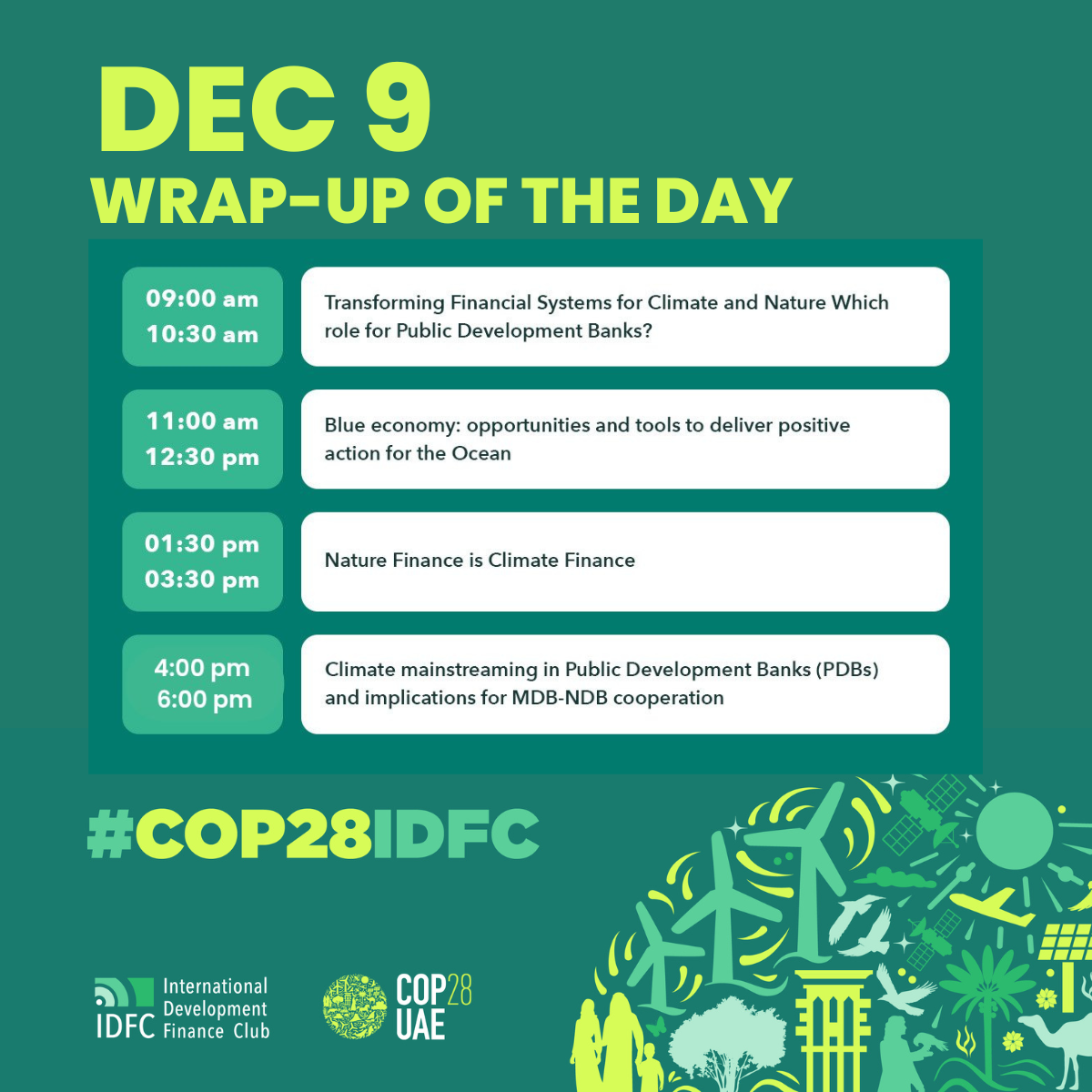

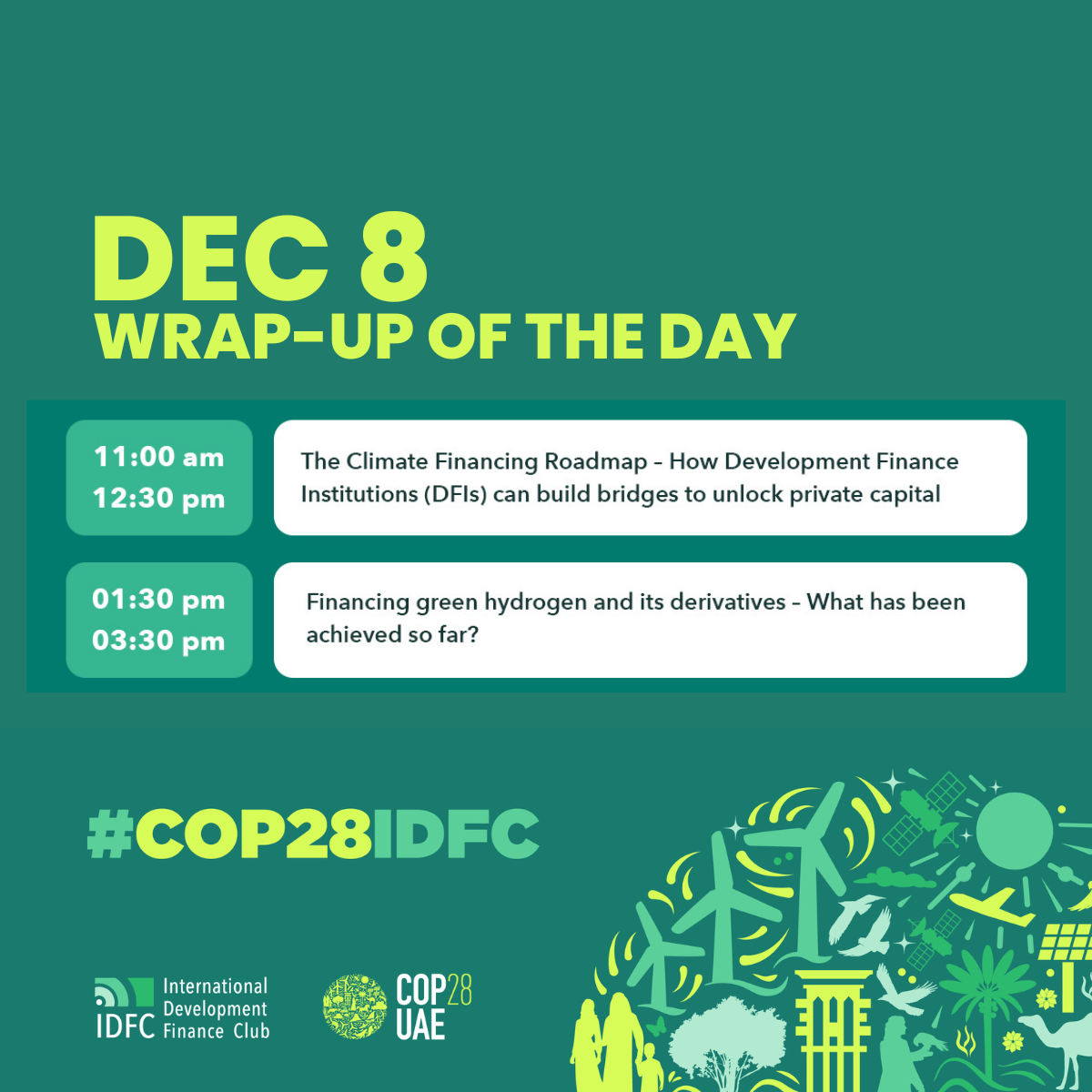

COP28IDFC DEC8 – Wrap up

9 December 2023Find below the topics tackled on the 8 of December and a summary for each.

We holded 2 events on DFIs and #greenhydrogen.

Watch the replay here:

11AM – The Climate Financing Roadmap – How Development Finance Institutions (DFIs) can build bridges to unlock private capital

The objective of this event was to join forces to support the global development and transformation agenda. Find solutions to overcome barriers to private capital mobilization.

- Moderator: Benayad Amine, Global Lead for Climate & Sustainability in Financial Institutions

- Wendy Woods, BCG, Vice Chair, Social Impact, Climate & Sustainability

- Stefan Wintels, CEO KfW

- Admassu Tadesse, TDB Group President Emeritus and Managing Director

Relevant interventions from panelists:

- Approximately 25 trillion EUR are needed to be mobilized in the fight against climate change by the end of the decade.

- The Development Finance Institutions (DFIs) will play a key role in mobilizing the investments needed for the climate transformation by building bridges between public and private capital, thus lowering corresponding investment barriers. In order to succeed, however, DFIs must transform themselves (at least partially). This includes expanding their product portfolio and partnerships, while simultaneously modernizing their processes and structures, and setting up their entire organization for the future.

- The KfW-BCG study presented during this side event specifically addresses levers and provides concrete impulses based on many great examples of DFIs worldwide that have already embarked on this journey.

- In addition, it is also necessary to improve the framework for climate financing, e.g., economic incentives for green investments, capital market reforms, or regulatory measures.

Calls for action:

- Development and promotional banks can pool their efforts in climate finance and leverage synergies by focusing on regional and global cooperation, e.g. via thematic initiatives such as ‘clean oceans’, or through joint digital platforms.

- They can adapt their product portfolio to meet the complex risk profiles of transformation and involve private capital extensively and over the long term, e.g. through investment consortia, risk assumption or the issuance of green bonds.

Deliverables:

🎙️ QUOTE | Wendy Woods from @BCG “there’s so much we can do to make our companies more adaptable and flexible.”#COP28 #COP28IDFC pic.twitter.com/TrHVKq49Ey

— International Development Finance Club (@IDFC_Network) December 8, 2023

2/2 We need development & promotional banks as enablers for the enormous financing requirements, by joining forces, mobilizing private capital & by driving impact. This is the only way to turn necessary innovations into business cases .The #DFIs are part of the solution.”

— International Development Finance Club (@IDFC_Network) December 8, 2023

“It is increasingly clear that development finance institutions have a pivotal role to play in bridging the vast climate finance gaps faced particularly by developing countries. DFIs, notably MDBs and IDFC members, have fairly unique abilities to be catalytic, to leverage, to take and reduce risk as well as to blend resources, financial and non-financial. Some like TDB are also pioneering new initiatives involving green and sustainable equity on its balance sheet and those of its subsidiaries; notable in this regard is our Class C Green+ shares, which we launched at COP 27.”

Admassu Tadesse, TDB Group President Emeritus and Managing Director

“We are in the middle of a decade of decisions. We have to shape the transformation and to expand funding for the climate and environment now. To this end, we need development and promotional banks as enablers for the enormous financing requirements, by joining forces, mobilizing private capital and by driving impact. This is the only way to turn necessary innovations into business cases. The Development Finance Institutions are part of the solution.”

Stefan Wintels, KfW CEO and Chairman of the Board of Management

Stefan Wintels @KfW CEO: IDFC, with its 26 members, is a wonderful example of global thinking. So let’s collaborate together, we want to play an important role because we are relevant and because we are relevant we need to lead by example” pic.twitter.com/8Gj7GoeOZ6

— International Development Finance Club (@IDFC_Network) December 8, 2023

1.30 PM Financing green hydrogen and its derivatives – What has been achieved so far?

Objective of this session was to discuss the current state of the international green hydrogen market ramp-up and how financing gaps can be closed.

- Karim Lotfi Senhadji, CFO, OCP S.A., Morocco

- Christiane Laibach, Board Member, KfW Banking Group

- Andrew Johnstone, Director and CEO, Climate Fund Managers (CFM)

- Lavinia Bauerochse, Managing Director, Head of ESG Corporate Bank, Deutsche Bank

- Pradeep Tharakan, Director Energy Transition, Asian Development Bank

- Barbara Schnell (Moderator), Head of Department, KfW Banking Group

Key takeaways of the session:

- Advances in technology are still needed

- Early-stage financing instruments are in place

- Project finance is really needed

- Integrated project concepts are crucial for the market ramp-up of PtX

- Supply certainty is key and having a supply demand

- Private and public sector have to work together on developing a global hydrogen market

- Strong industry players like OCP S.A. are in good position to spearhead the market ramp-up for green hydrogen.

Some other important points highlithed by the panel:

- The revenues/demands do not come only from developed economies; there is a demand on local markets within the EMDEs as well (e.g., Morocco)

- We need different financing instruments for investments at the right time and when its needed! Actually, we still have the chicken & egg issue to solve.

- To give confidence to potential off-takers as well as the producers, we need the public sector to reduce risks both on the CAPEX and OPEX side

#COP28

During this session, the panel discussed the current state of the international #greenhydrogen market ramp-up and how financing gaps can be closed in different countries such as the example of Karim Lotfi Senhadji @ocpgroup in #Morocco#cop28idfc pic.twitter.com/XWvvbI7TVm— International Development Finance Club (@IDFC_Network) December 8, 2023