IDFC taking the lead on Nature & Biodiversity at FiCS 2025

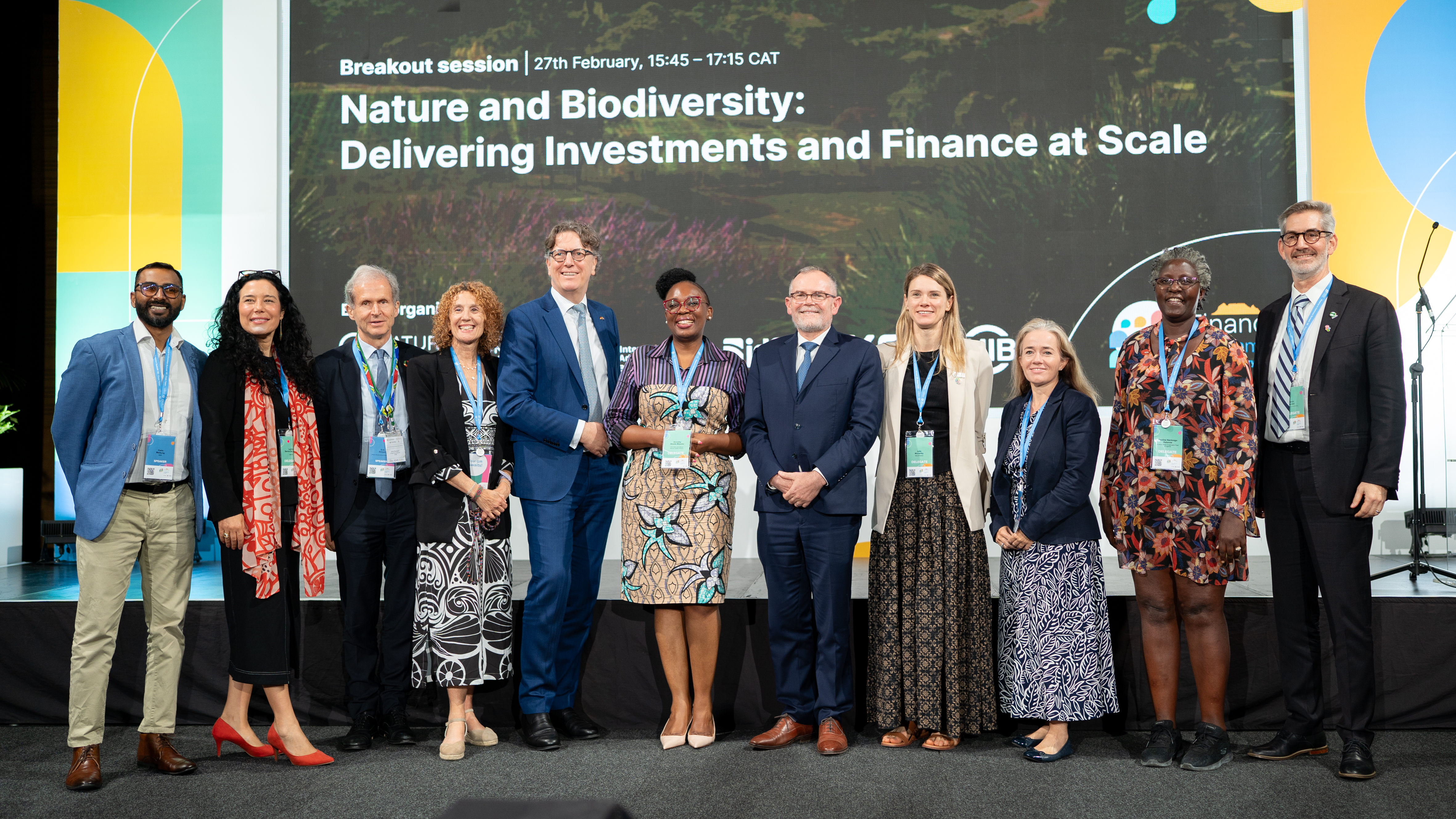

8 April 2025IDFC was co-hosting the session “Nature and Biodiversity: Delivering Investments and Finance at Scale” along with the Asian Infrastructure Investment Bank (AIIB), the International Advisory Panel on Biodiversity Credits (IAPB), KfW, NatureFinance and the World Economic Forum (WEF) at the last Finance in Common Summit (FiCS) in Cape Town, in South Africa. This event was a significant opportunity for IDFC members to engage and participate in key discussions on nature finance.

The session allowed the participants to hear from multilateral and public development banks (MDBs and PDBs) and finance actors on:

- Concrete case studies on Nature as Infrastructure, demonstrating how investments in nature-based solutions can generate both environmental and economic outcomes

- Innovative financial tools, including biodiversity credits and performance-based financing instruments, with an emphasis on strengthening natural capital accounting and building enabling policy and regulatory frameworks to scale up nature-focused investments.

- The pivotal role of development banks and financial institutions in creating the conditions for nature finance to thrive, through alignment with global biodiversity objectives and the integration of nature into investment decision-making

- Expert perspectives from development banks, private finance, and policy leaders

- Forward-looking solutions aligned with the Kunming-Montreal Global Biodiversity Framework (GBF)

Stefan Wintels, CEO of KfW

- Moderator: Ms. Dorothy Maseke, Lead Nature Finance & TNFD, Africa Natural Capital Alliance (ANCA)

- Keynote address: Hon. Dr. Dion George, South African Minister of Forestry, Fishery and Environment

- Scene setting: Stefan Wintels, CEO of KfW, underlined the crucial role of public development banks in enabling nature finance and reaffirmed KfW’s commitment to innovative financing approaches for biodiversity.

Part 1: Nature as infrastructure

The discussion emphasized the practical integration of nature as a strategic infrastructure asset within development and investment frameworks.

Panelists:

- Erik Berglof, Chief Economist, AIIB

- Julie McCarthy, CEO, Nature Finance

- Lavinia Barros de Castro, BNDES

- Pauline Nantongo, ED of Ecotrust and Member, IAPB

Part 2: Enabling nature finance

Experts discussed the key factors needed to expand nature finance, such as valuing natural capital, developing innovative financing solutions, and ensuring that MDBs and PDBs align their actions with the Kunming-Montreal Global Biodiversity Framework (GBF).

Panelists:

- Alicia Montalvo, Head of Climate and Biodiversity Department, Development Bank of Latin America & the Caribbean (CAF)

- Candice Dott, Head of Global Engagement, TNFD

- Cerin Maduray, Sustainable Finance Lead, WWF South Africa

- Kevin Bender, Director, Greening Sovereign Debt – TNC

Key takeaways of the session:

- Nature as an economic foundation and pathway to sustainability: Natural assets are fundamental to human wellbeing and economic prosperity. Approximately 25% of climate solutions are Nature-based Solutions (NbS), highlighting the critical need to integrate nature into economic frameworks and national balance sheets.

- Financing transition: A fundamental shift in economic and financial systems is required to safeguard nature for economic well-being and resilience. This includes redirecting investments from harmful activities toward nature-positive initiatives and expanding beyond public and philanthropic capital by engaging the private sector.

- Credit Enhancement as Strategic Tool: Credit enhancement mechanisms are crucial for mobilizing capital at scale for nature financing, creating fiscal space for developing nations, and reducing financial pressure that leads to nature degradation.

- Integrated Approach: Climate and nature must be viewed as interconnected systems requiring alignment of policies, measurement frameworks, and financial instruments. The session emphasized moving from awareness to coordinated action at scale.

Commitments or Deliverables

A proposition was put forth to establish a dedicated Nature Finance Working Group within the Finance for Climate and Sustainability (FiCS) framework. This working group would serve as a coordination platform to align diverse initiatives, prevent fragmentation, and accelerate knowledge transfer across institutional boundaries aligned with the nature and climate agenda.

As part of supporting and contributing to the creation of an enabling environment for innovative financing to trickle in nature and climate investments, participants got insights into the International Advisory Panel on Biodiversity credits (IAPB) principles for high-integrity biodiversity credits, launched at COP16. These principles are meant to establish a foundational framework to guide market development with links to standards for measurement, verification, additionality, permanence, and equitable benefit distribution—addressing critical challenges that have hindered market growth to date.

Furthermore, the session enabled participants to share knowledge and key findings and as well as enhancing the capacity of financial institutions and policymakers to design and implement effective biodiversity finance strategies. It was also the opportunity to call for action on the following topics:

- Develop more specialized financial products

- Mainstream Nature Risk Assessment

- Build Technical Capacity Across Stakeholder Groups

These outcomes demonstrate alignment with FiCS’ goals but also provide concrete steps towards achieving a more sustainable and inclusive global financial system.

Replay available

Couldn’t attend the session or want to revisit the discussions?

Watch the full session replay below to hear directly from experts, panelists, and key stakeholders on how public development banks and financial institutions are driving investments in nature-based solutions.